All Categories

Featured

Table of Contents

Here are some kinds of non-traditional living advantages bikers: If the policyholder outlasts the regard to their term life insurance policy, the return of costs motorcyclist makes sure that all or part of the costs paid are returned to the policyholder. This can appeal to those that want the guarantee of obtaining their money back if the plan is never used.

The insurer will certainly either cover the premiums or waive them.: The ensured insurability biker enables the insurance policy holder to acquire extra coverage at details intervals without verifying insurability. Useful for those that prepare for requiring a lot more protection in the future, particularly important for younger insurance policy holders whose needs might boost with life occasions like marriage or giving birth.

How do I cancel Accidental Death?

Offering financial alleviation throughout the uncomfortable occasion of a child's death, covering funeral service expenses, and enabling pause job. The price of living change rider assists to make sure that the policy's advantages are protected from inflation so that the survivor benefit continues to be in line with the increasing living expenses. if the insurance policy holder ends up being disabled and can not function, the Impairment Revenue Rider supplies a monthly revenue for a specified period.

Rather than focusing on nursing homes or helped living centers, the Home Health care Cyclist gives advantages if the insured requires home medical care services. Permits people to obtain care in the convenience of their very own homes.

Makes sure the plan doesn't gap during durations of monetary hardship due to joblessness. The cost, benefit amount, duration, and certain triggers differ extensively amongst insurance coverage service providers.

Not everyone is immediately qualified forever insurance coverage living benefit plan cyclists. The specific qualification requirements can depend on several elements, consisting of the insurance coverage company's underwriting guidelines, the type and term of the plan, and the certain motorcyclist asked for. Below are some common aspects that insurance providers might take into consideration:: Just particular kinds of life insurance policy plans might use living benefits cyclists or have them consisted of as standard functions.

What is Life Insurance Plans?

: Lots of insurance coverage firms have age restrictions when adding or working out living benefits motorcyclists. For example, an essential health problem biker may be available just to insurance holders listed below a particular age, such as 65.: Preliminary qualification can be affected by the insured's health condition. Some pre-existing conditions might make it challenging to get specific cyclists, or they could result in higher premiums.

For example:: An insurance holder might require to be detected with among the protected vital illnesses.: The insured could need to verify they can not perform a set number of Activities of Daily Living (ADLs). : A medical specialist usually must identify the insurance holder with a terminal ailment, having a specified time (e.g., twelve month) to live

Who provides the best Life Insurance?

A return of premium cyclist on a term policy might just be offered if the insurance policy holder outlasts the whole term.: For certain cyclists, especially those associated to health and wellness, like the critical disease cyclist, extra underwriting may be called for. This might include medical exams or detailed health questionnaires.

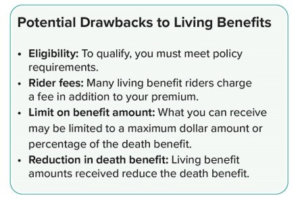

While life insurance coverage with living benefits supplies an added layer of defense and adaptability, it's important to be aware of possible disadvantages to make an educated decision. Below are some prospective disadvantages to think about:: Accessing living advantages usually suggests that the survivor benefit is lowered by the quantity you withdraw.

How do I cancel Life Insurance Plans?

: Including living benefits bikers to a plan could result in higher costs than a typical policy without such riders.: There might be caps on the amount you can take out under living benefits. As an example, some policies might restrict you to 50% or 75% of the death benefit.: Living advantages can introduce additional intricacy to the plan.

While supplying a precise buck amount without particular information is challenging, right here are the typical variables and factors to consider that affect the expense. Life insurance policy business price their items in different ways based on their underwriting standards and take the chance of evaluation designs. Age, health, way of life, line of work, life span, and whether you smoke can all affect the cost of a life insurance coverage costs, and this rollovers into the cost of a motorcyclist as well.

Whether living advantage cyclists are worth it depends upon your conditions, financial objectives, and threat resistance. They can be a useful enhancement for some individuals, however the extra cost may not be validated for others. Below are a few considerations to help figure out if it could be appropriate for you:: If your family has a significant background of health problems, an essential illness cyclist could make even more sense for you.

One of the benefits of being insured is that you make plans to put your life insurance coverage in to a depend on. This gives you better control over who will benefit from your plan (the beneficiaries). You appoint trustees to hold the cash money amount from your policy, they will certainly have discretion regarding which among the recipients to pass it on t, just how much each will obtain and when.

What are the benefits of Trust Planning?

Find out more regarding life insurance and tax obligation. It's essential to keep in mind that life insurance policy is not a financial savings or financial investment strategy and has no cash money worth unless a legitimate insurance claim is made.

The company will certainly assist in collaborating any advantages that may be due. VRS has actually acquired with Securian Financial as the insurance firm for the Group Life Insurance Coverage Program.

If you were covered under the VRS Team Life Insurance Policy Program as a member, some advantages continue into retirement, or if you are eligible to retire but delay retirement. Your coverage will end if you do not satisfy the age and solution demands for retirement or you take a refund of your member contributions and interest.

The decrease rate is 25% each January 1 until it reaches 25% of the total life insurance policy advantage value at retired life. If you have at the very least 30 years of solution credit, your coverage can not lower listed below $9,532. This minimum will be boosted annually based upon the VRS Plan 2 cost-of-living change computation.

What is the most popular Premium Plans plan in 2024?

On January 1, 2028, your life insurance policy protection lowers to $50,000. On January 1 following 3 fiscal year after your work ends (January through December), your life insurance policy protection reduces a last 25% and stays at that value for the rest of your retirement. Your final reduction will certainly get on January 1, 2029, and your insurance coverage will continue to be at $25,000 * for the rest of your retirement.

Latest Posts

Funeral Insurance For Seniors Over 80

Instant Quote For Life Insurance

Affordable Burial Insurance Policies