All Categories

Featured

Table of Contents

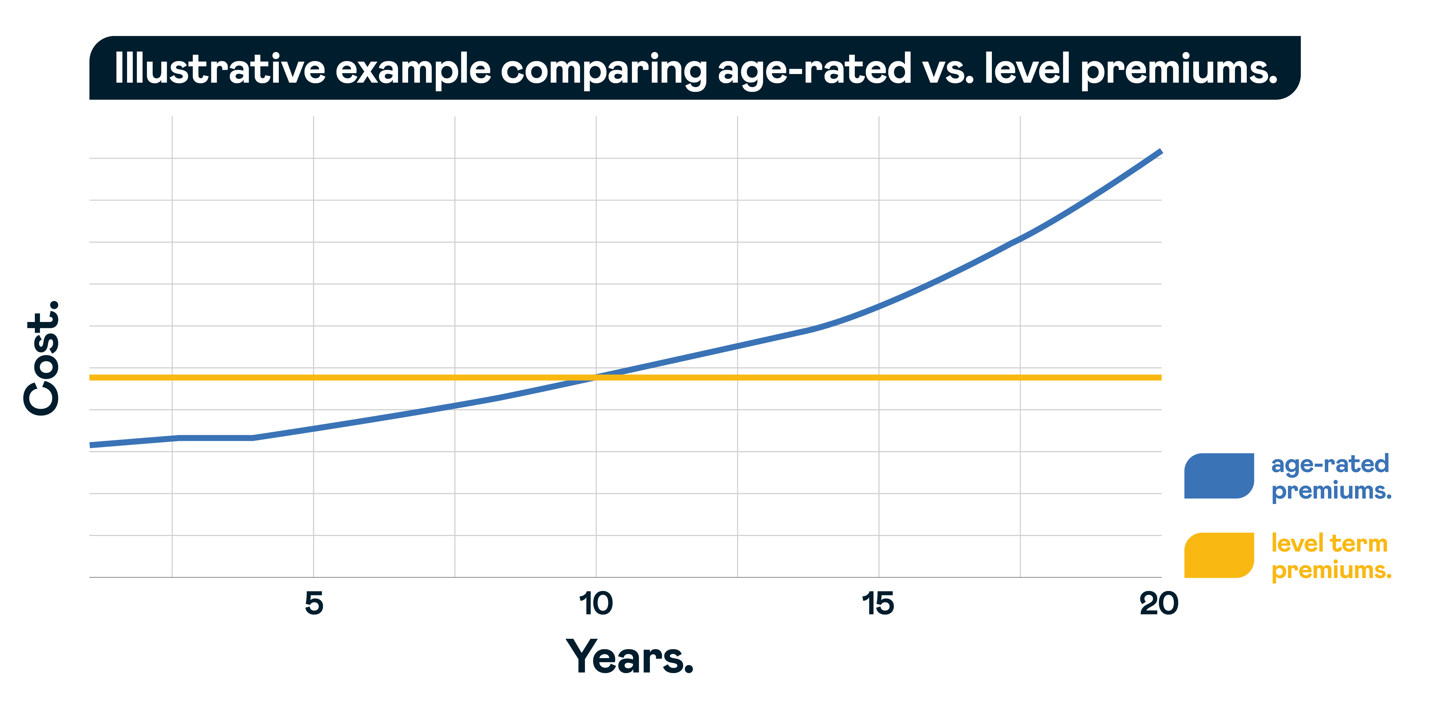

A level term life insurance policy policy can give you satisfaction that the people that depend on you will have a fatality advantage during the years that you are preparing to support them. It's a means to help deal with them in the future, today. A level term life insurance policy (often called degree premium term life insurance) policy gives insurance coverage for a set variety of years (e.g., 10 or two decades) while maintaining the costs settlements the same for the period of the policy.

With level term insurance coverage, the expense of the insurance policy will certainly remain the very same (or potentially lower if rewards are paid) over the regard to your plan, normally 10 or two decades. Unlike long-term life insurance policy, which never ever expires as long as you pay premiums, a level term life insurance coverage plan will certainly finish eventually in the future, normally at the end of the period of your level term.

What is 10-year Level Term Life Insurance? Pros, Cons, and Considerations?

Since of this, several individuals make use of permanent insurance policy as a secure monetary planning tool that can serve several demands. You may have the ability to convert some, or all, of your term insurance coverage during a collection duration, typically the initial 10 years of your policy, without requiring to re-qualify for coverage also if your health has altered.

As it does, you may desire to add to your insurance coverage in the future - Level benefit term life insurance. As this happens, you might desire to eventually lower your fatality advantage or take into consideration converting your term insurance coverage to a permanent policy.

Long as you pay your costs, you can relax simple knowing that your enjoyed ones will certainly receive a fatality benefit if you die during the term. Lots of term policies allow you the ability to transform to long-term insurance policy without needing to take another health exam. This can allow you to capitalize on the added benefits of a long-term policy.

Degree term life insurance policy is among the most convenient paths into life insurance policy, we'll discuss the benefits and disadvantages so that you can choose a plan to fit your requirements. Level term life insurance coverage is one of the most common and standard form of term life. When you're seeking short-lived life insurance policy plans, degree term life insurance is one course that you can go.

The application procedure for level term life insurance policy is typically extremely simple. You'll submit an application which contains general individual information such as your name, age, and so on in addition to a much more thorough set of questions concerning your case history. Depending on the plan you're interested in, you might have to participate in a medical exam procedure.

The brief response is no. A degree term life insurance policy plan doesn't construct money value. If you're seeking to have a policy that you're able to withdraw or borrow from, you may explore long-term life insurance coverage. Whole life insurance coverage policies, for instance, let you have the convenience of fatality advantages and can accumulate cash money worth gradually, suggesting you'll have much more control over your benefits while you live.

How Does What Is Level Term Life Insurance Benefit Families?

Riders are optional provisions included to your policy that can give you extra advantages and securities. Anything can take place over the program of your life insurance coverage term, and you desire to be ready for anything.

This cyclist supplies term life insurance on your children via the ages of 18-25. There are instances where these benefits are developed into your plan, but they can likewise be offered as a different addition that calls for additional payment. This rider offers an extra survivor benefit to your beneficiary should you die as the result of an accident.

Latest Posts

Funeral Insurance For Seniors Over 80

Instant Quote For Life Insurance

Affordable Burial Insurance Policies