All Categories

Featured

Table of Contents

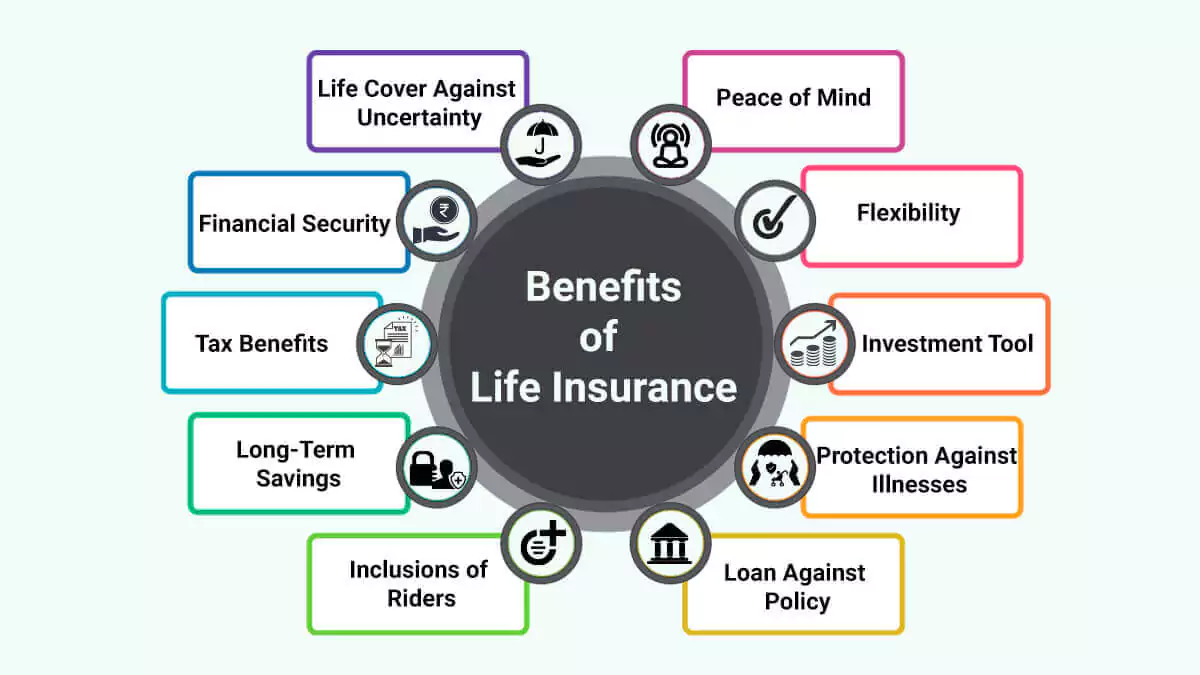

Life insurance policy gives five economic benefits for you and your family. The main benefit of adding life insurance coverage to your financial plan is that if you pass away, your heirs get a swelling sum, tax-free payment from the plan. They can utilize this cash to pay your last costs and to replace your revenue.

Some policies pay if you establish a chronic/terminal illness and some give savings you can make use of to support your retirement. In this article, find out about the numerous benefits of life insurance policy and why it may be a great concept to spend in it. Life insurance offers advantages while you're still to life and when you die.

What are the top Accidental Death providers in my area?

Life insurance coverage payouts normally are income-tax complimentary. Some irreversible life insurance policy plans build money value, which is cash you can take out while still alive.

If you have a policy (or policies) of that size, the individuals who depend on your income will certainly still have money to cover their recurring living costs. Recipients can use policy advantages to cover vital daily expenditures like rental fee or home mortgage payments, utility costs, and groceries. Ordinary yearly expenses for households in 2022 were $72,967, according to the Bureau of Labor Stats.

Life insurance coverage payments aren't considered earnings for tax functions, and your recipients do not need to report the cash when they submit their income tax return. Nevertheless, a beneficiary might receive gained interest if they select an installment payment choice. Any type of rate of interest gotten is taxable and should be reported because of this. Depending upon your state's regulations, life insurance policy benefits might be utilized to counter some or all of owed inheritance tax.

Growth is not influenced by market conditions, enabling the funds to accumulate at a stable price gradually. Furthermore, the money value of entire life insurance policy expands tax-deferred. This suggests there are no earnings taxes accrued on the cash worth (or its development) till it is taken out. As the cash worth builds up over time, you can utilize it to cover expenditures, such as acquiring an automobile or making a deposit on a home.

How can I secure Protection Plans quickly?

If you decide to borrow against your cash worth, the finance is exempt to income tax as long as the plan is not surrendered. The insurance provider, nonetheless, will bill passion on the finance amount until you pay it back. Insurer have differing rate of interest on these lendings.

For example, 8 out of 10 Millennials overstated the price of life insurance policy in a 2022 research. In actuality, the average expense is closer to $200 a year. If you assume buying life insurance policy may be a clever economic relocation for you and your family members, think about seeking advice from a financial expert to embrace it into your economic plan.

How long does Beneficiaries coverage last?

The 5 major sorts of life insurance policy are term life, entire life, universal life, variable life, and last expenditure protection, also referred to as interment insurance. Each kind has various features and benefits. Term is much more budget-friendly however has an expiration day. Entire life starts costing more, yet can last your entire life if you keep paying the premiums.

Life insurance coverage can additionally cover your mortgage and provide cash for your family members to maintain paying their bills. If you have household depending on your revenue, you likely require life insurance policy to support them after you pass away.

Minimal amounts are readily available in increments of $10,000. Under this plan, the chosen coverage takes effect two years after registration as long as costs are paid during the two-year period.

Coverage can be expanded for up to 2 years if the Servicemember is totally disabled at splitting up. SGLI protection is automatic for most active obligation Servicemembers, Ready Book and National Guard participants arranged to execute at the very least 12 durations of non-active training per year, members of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health and wellness Solution, cadets and midshipmen of the United state

VMLI is available to Veterans who experts a Obtained Adapted Particularly Adjusted (SAH), have title to the home, and have a mortgage on the home. All Servicemembers with full time insurance coverage should use the SGLI Online Registration System (SOES) to mark beneficiaries, or minimize, decline or bring back SGLI insurance coverage.

Participants with part-time coverage or do not have access to SOES should use SGLV 8286 to make adjustments to SGLI (Life insurance). Total and file form SGLV 8714 or request VGLI online. All Servicemembers need to utilize SOES to decline, decrease, or bring back FSGLI insurance coverage. To accessibility SOES, go to www.milconnect.dmdc.osd.mil/milconnect/. Participants that do not have accessibility to SOES ought to use SGLV 8286A to to make adjustments to FSGLI coverage.

Wealth Transfer Plans

Plan advantages are decreased by any kind of exceptional car loan or lending passion and/or withdrawals. Returns, if any kind of, are affected by plan fundings and loan passion. Withdrawals over the expense basis may lead to taxable regular income. If the policy lapses, or is surrendered, any impressive financings thought about gain in the plan might go through average revenue tax obligations.

If the policy proprietor is under 59, any type of taxable withdrawal may also be subject to a 10% government tax obligation penalty. All whole life insurance policy guarantees are subject to the prompt settlement of all called for premiums and the cases paying capacity of the providing insurance policy firm.

.jpg)

The cash abandonment value, funding value and death profits payable will be decreased by any type of lien exceptional due to the settlement of a sped up benefit under this cyclist. The accelerated advantages in the very first year reflect deduction of a single $250 administrative fee, indexed at an inflation rate of 3% per year to the price of velocity.

A Waiver of Costs motorcyclist forgoes the responsibility for the insurance policy holder to pay more costs should he or she come to be absolutely handicapped constantly for a minimum of six months. This motorcyclist will sustain an added cost. See policy agreement for additional information and requirements.

Life Insurance

Find out more about when to obtain life insurance policy. A 10-year term life insurance policy plan from eFinancial expenses $2025 each month for a healthy adult that's 2040 years old. * Term life insurance is extra cost effective than long-term life insurance policy, and women consumers typically obtain a lower price than male clients of the same age and health status.

Latest Posts

What Makes Short Term Life Insurance Stand Out?

Why should I have Accidental Death?

Who provides the best Whole Life Insurance?